Gap insurance is also commonly referred to as auto loan/lease coverage.

Like many things in life, gap insurance is one of those things that is important to know about before you need it.

To answer all your questions about this important coverage, we talked with our auto underwriting team for insights.

- What is gap insurance?

- What’s an example of how gap insurance works?

- What is the most gap insurance will pay?

- Who might need gap insurance?

- How can I buy gap insurance?

1. What is gap insurance?

Gap insurance (or auto loan/lease coverage) is an additional coverage you can add to your car insurance policy. It covers the remaining loan or lease amount you may have on your vehicle if it’s totaled in a covered accident.

So, if your car is damaged in an accident and your insurance company deems it a total loss, your insurance company will pay off your remaining loan balance rather than just the current value of your vehicle considering age, condition and mileage. This loss of value over time is called depreciation.

Read more: Totaled Car? Here’s What You Need to Know and What Happens Next

Without this coverage, you would be responsible for the “gap” (hence its name) between what’s left on your loan and your vehicle’s current, depreciated value.

For example, if your vehicle is totaled in a covered accident, your insurance company will provide you with a claim payout equal to your vehicle’s depreciated value (less any deductible). Depending on the amount of your loan and the depreciation on your specific vehicle, the amount your insurance company pays you may be less than the amount left on your loan. This leaves you having to pay that remaining amount. However, with gap insurance, your insurance company would pay the remaining loan amount.

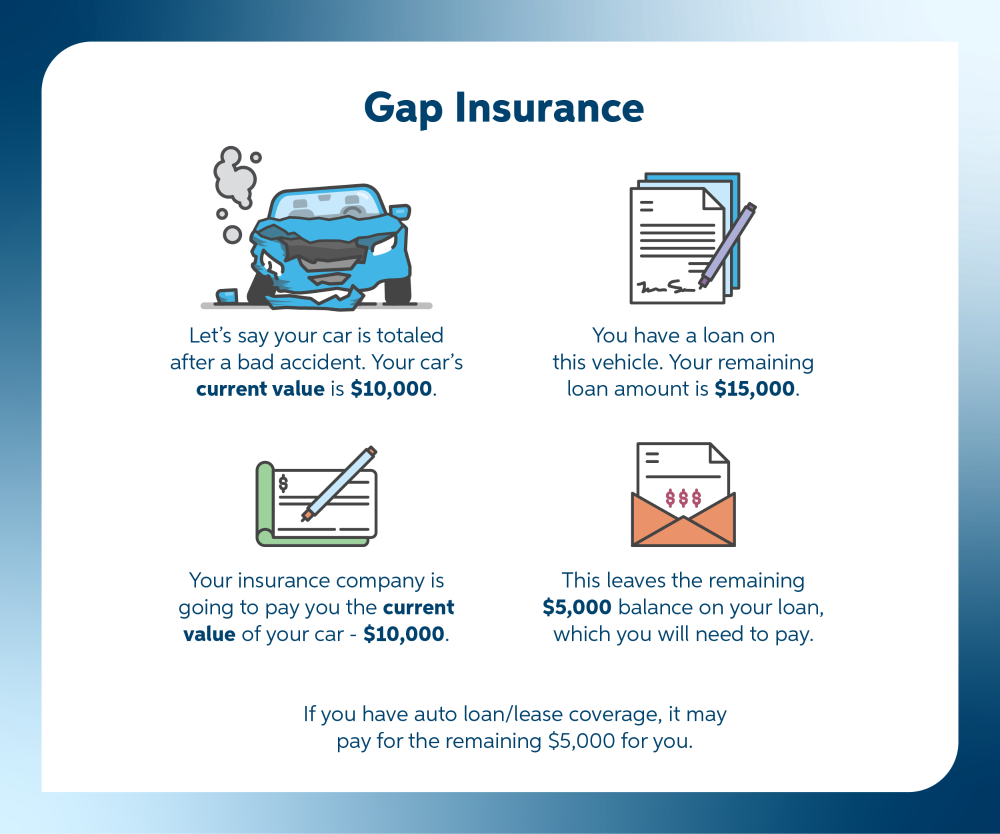

2. What’s an example of how gap insurance works?

Let’s say your car is totaled after a bad accident. Your car’s current value is $10,000.

You have a loan on this vehicle. Your remaining loan amount is $12,000.

Your insurance company is going to pay you the current value of your car ($10,000).

This leaves a remaining $2,000 balance on your loan, which you will need to pay. If you have auto loan/lease coverage, it may pay the remaining $2,000 for you.

3. What is the most gap insurance will pay?

In general, your insurance will pay the lender based on what you owe on your vehicle and the coverages your policy has, but this can vary depending on your claim.

4. Who might need gap insurance?

If you either took out a loan to pay for your vehicle or it’s under a lease, you may want to consider gap insurance.

Other factors that may influence your decision include:

- The amount of principal left on your loan

- The age of the vehicle

- Your personal financial situation

5. How can I buy gap insurance?

To buy gap insurance, you’ll likely need to have a car insurance policy that includes the comprehensive (other than collision) and collision coverages. Most companies will require you have both of these coverages on your vehicle’s policy before they will add an auto loan/lease gap coverage.

We, of course, think that contacting your local, independent insurance agent or your car insurance company is the best first step. Car dealerships do offer gap insurance, but it’s often more expensive than just adding it to your existing car insurance policy.

To start the process of adding auto loan/lease coverage to your car insurance, contact your local independent agent today.

Learn more about our auto insurance and ways to save

Copyright Auto-Owners Insurance Company © 2023. All Rights Reserved.